Section 179 calculator

Special rules for heavy SUVs. Under Section 179 you can claim a deduction in the current year.

Bellamy Strickland Commercial Truck Section 179 Deduction

The total amount you can take as section 179 deductions for most property including vehicles placed in service in a specific year cant be more than 1 million.

. Comparing mortgage terms ie. High Definition Twin Head Plasma Hi-Speed Plasma Flame Profiling Laser Cutting. Leveraging Section 179 of the IRS tax code could be the best financial decision you make this year.

However for those weighing more than 6000 pounds -- many SUVs meet this weight threshold -- theres a. The Section 179 deduction is limited to. And then use the section 179 exclusion.

The amount of taxable income from an active trade or business. SIGN YOUR APPROVAL FOR SECTION 179 Your voice matters. A Ram truck is generally considered Section 179 property for US.

Learn how tax benefits for equipment financing make it easier to keep more cash in your pocket. Read more about these strategies. The Section 179 deduction generally is barred for vehicles.

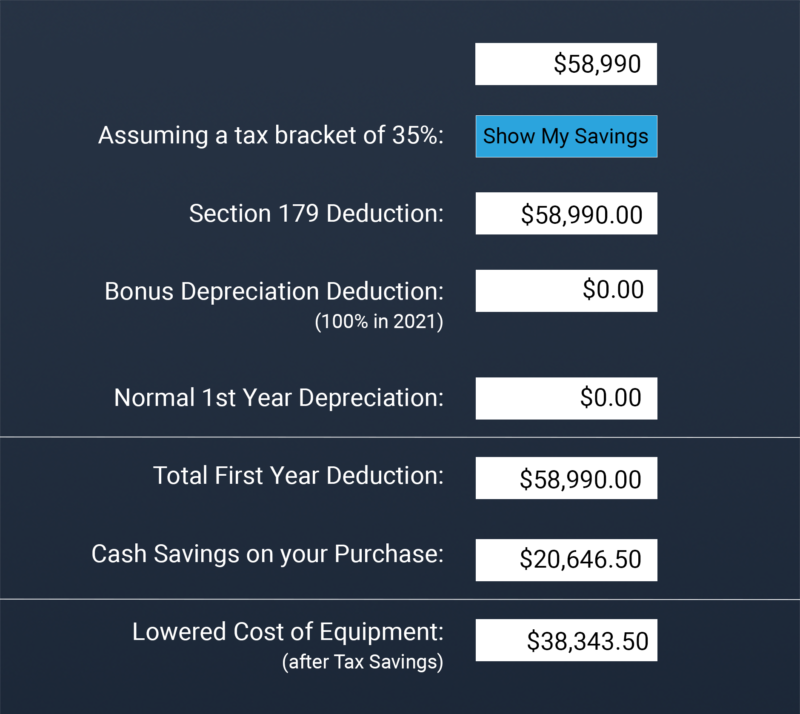

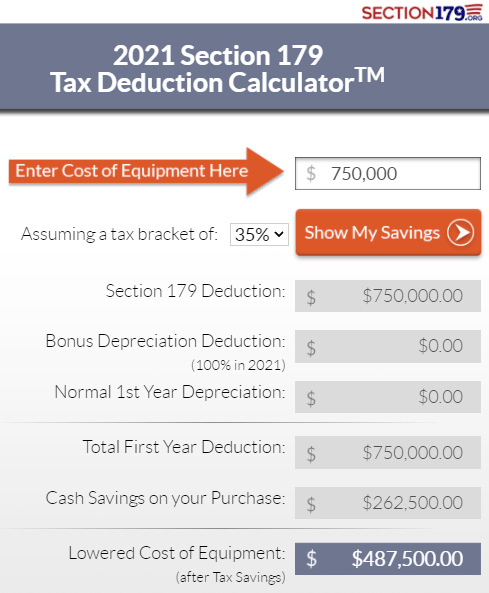

Calculate your potential savings with our 2022 Section 179 tax deduction calculator. Section 179 Deduction Calculator. Jan 07 2022 Yes You can finance your vehicle by putting minimal down and still take section 179 or Bonus depreciation on the vehicles.

Section 179 Calculator. You can claim the Section 179 deduction when you placed these types of property into service during the tax year. Paycheck Protection Program PPP Loans through SBA.

When you finance equipment you can get the latest model while enjoying accelerated tax benefits through Section 179. 26200 for SUVs and other vehicles rated at more than 6000 pounds but not more than 14000 pounds. The list of vehicles that can get a Section 179 Tax Write-Off include.

The Section 179 Tax Deduction covers business supplies upgrades improvements and property that is purchased or leased in the same calendar year. The IRS set up Section 179 deductions to help businesses by allowing them to take a depreciation deduction for certain business assetslike machinery equipment and vehiclesin the first year these assets are placed in service. In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently updated for the 2022 tax year.

Or you can use a 1031 exchange to defer depreciation recapture taxes. In this article Calculate. Applying for equipment financing could be the most profitable decision you make for your business and your 2022 tax returns.

Since the deduction was created with all businesses in mind the list includes purchases that many companies need. In other words all section 179 deductions for all business property for a year cant be greater than 1 million. Federal income tax purposes.

Let us say you finance a 45000 heavy SUV and use it 100 for your small business. This means a taxpayer may elect to treat the cost of any Section 179 property as an expense and allowed as a deduction for the taxable year in which the property is. Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs.

Youd do this by deducting all or a portion of the cost of certain property as opposed to depreciating it. Savings refer to the reduction in the energy and power costs of the combined energy for the interior lighting HVAC and hot water systems as compared to a reference building that meets the minimum requirements of ASHRAE Standard 901-2007 for properties placed in service on or before December 31 2020. That means youre able to deduct up to 1050000 in 2021 for the purchase of new or used equipment software and other assets.

The maximum Section 179 expense deduction is 1050000. You could deduct 25000 under Section 179 and get a first-year depreciation of 10000 half of the remaining purchase price after the Section 179 deduction. The dollar amount is adjusted each year for inflation.

Simply use a measuring tape to measure the circumference of the tree input the type of tree and then click on the Calculate button to calculate the trees age. Heavy vehicles have a Section 179 deduction cap of 25000. This PERT calculator can be employed for swift computation of the likelihood of your project being completed within the desired timeframe on the basis of the Program Evaluation and Review Technique PERT.

15 20 30 year Should I pay discount points for A lower interest rate. Payments Repayments Calculator. Section179Org successfully petitioned Congress to raise the Section 179 limit and with your support well ensure it remains strong.

What Vehicles Qualify for the Section 179 Deduction in 2022. Section 179 can do wonders for your books especially if your company is in need of positive cash flow. The multiplicative inverse of a modulo m exists if and only if a and m are coprime ie if gcda m 1If the modular multiplicative inverse of a modulo m exists the operation of.

Just enter your equipment cost below. You can use this simple tree age calculator to determine the estimated age of living trees. Gross vehicle weight can qualify for at least a partial Section 179 deduction plus bonus depreciation.

For example if you are purchasing a SUV for 110000 you can put 10000 down payment finance remaining 100000 over 5 years yet still claim 110000 dollars in tax deduction using section 179 and Bonus Depreciation. The concept of depreciation for an asset is to spread the cost of using the asset over a number of years the assets useful life by. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange.

SIGN YOUR APPROVAL FOR SECTION 179 Your voice matters. Qualified tangible personal property. The modular multiplicative inverse of an integer a modulo m is an integer b such that It may be denoted as where the fact that the inversion is m-modular is implicit.

If you couple this dollar-for-dollar reduction to taxable income. Section179Org successfully petitioned Congress to raise the Section 179 limit and with your support well ensure it remains strong. Employer FSA Savings Calculator.

In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently updated for the 2022 tax year. Its reduced dollar-for-dollar for qualified expenditures more than 2 million. What are my tax savings with Section 179 deduction.

Section 179 Tax Savings When You Buy Now Dt Photo

Write Off Your Entire Purchase In 2021 With Section 179 Deduction Advancedtek

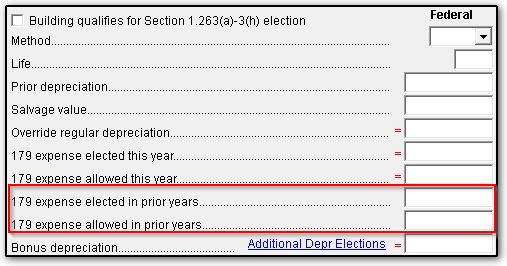

4562 Section 179 Data Entry

Smart Dtg Printer Owners Take Advantage Of The Section 179 Tax Deduction Ricoh Dtg

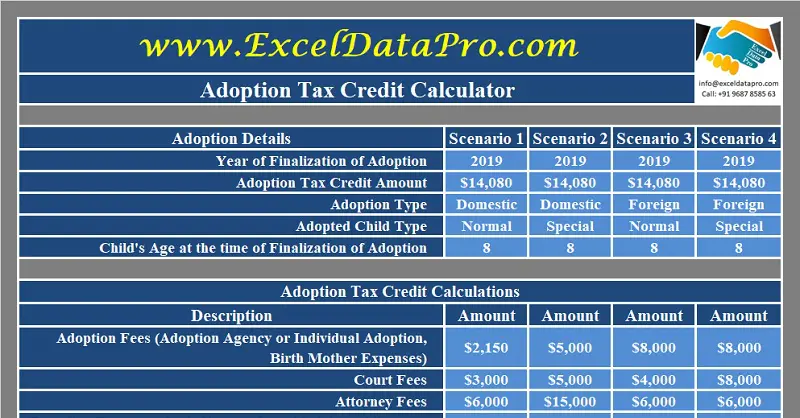

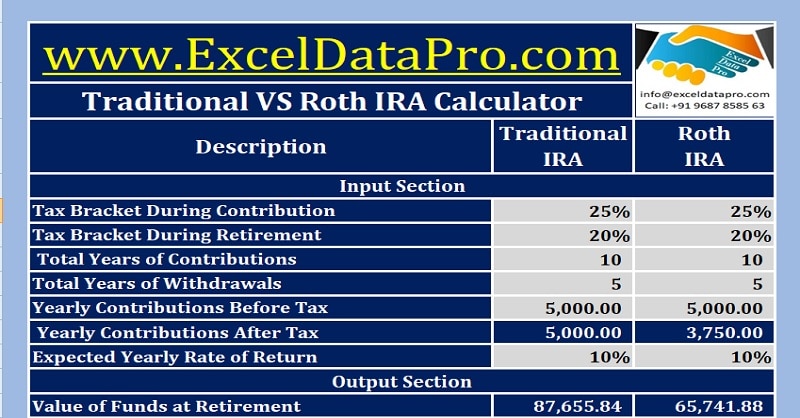

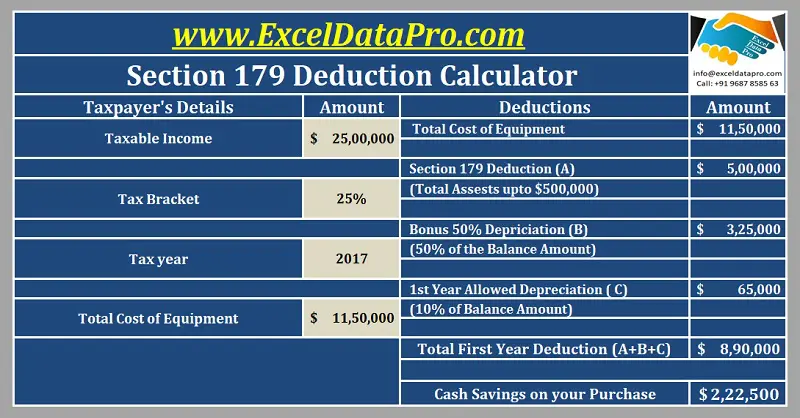

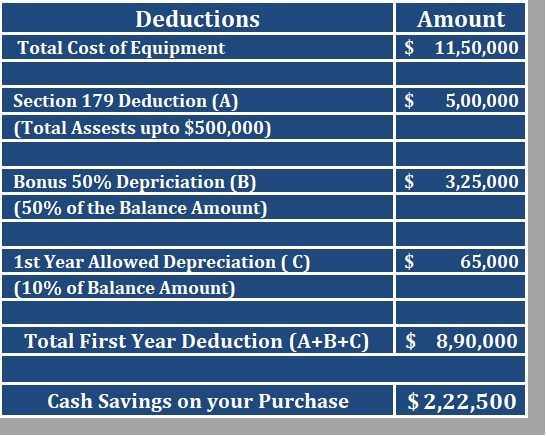

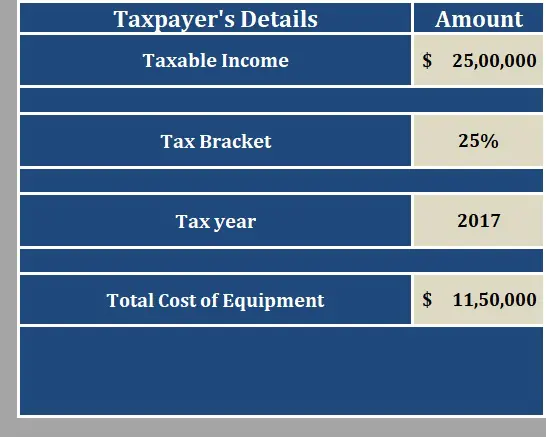

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Section 179 Deduction Calculator Excel Template Exceldatapro

4562 Section 179 Data Entry

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Section 179 Deduction Fmi Truck Sales And Service Oregon

2021 Section 179 Tax Savings Your Business May Deduct 1 050 000 Youtube

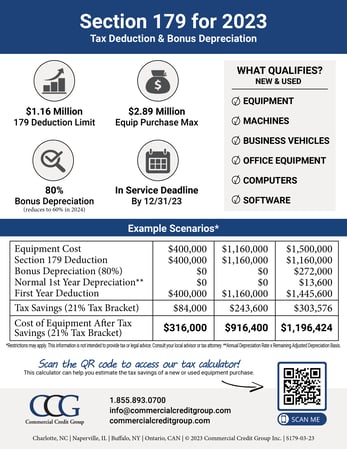

Section 179 Calculator Ccg

The Current State Of The Section 179 Tax Deduction

Section 179 Tax Deduction Official 2019 Calculator Crest Capital

Section 179 Calculator Ccg

2021 Section 179 Deduction Tax Incentive Purple Platypus